PZU Grupowe Ubezpieczenie Pracownicze Typ P Plus Pobyt W Szpitalu. This might sound complicated. Let’s break it down simply for educators. The goal is to understand what this is.

What is It?

Think of it as a safety net. This insurance policy covers employees. It provides financial help. Especially during hospital stays. It's offered as a group benefit. It’s usually through an employer like a school district.

PZU is the insurance company. "Grupowe" means it's a group policy. "Pracownicze" means it is designed for workers. "Typ P Plus" is the specific plan type. It signifies coverage levels and features. "Pobyt W Szpitalu" is a key feature. It provides benefits during hospitalization.

Key Features Explained

Hospital stay coverage is the focus. This is a lump-sum payment. This helps with expenses during hospitalization. The money can be used for anything. From medical bills to daily needs. It supplements existing health insurance. It provides an extra layer of financial support.

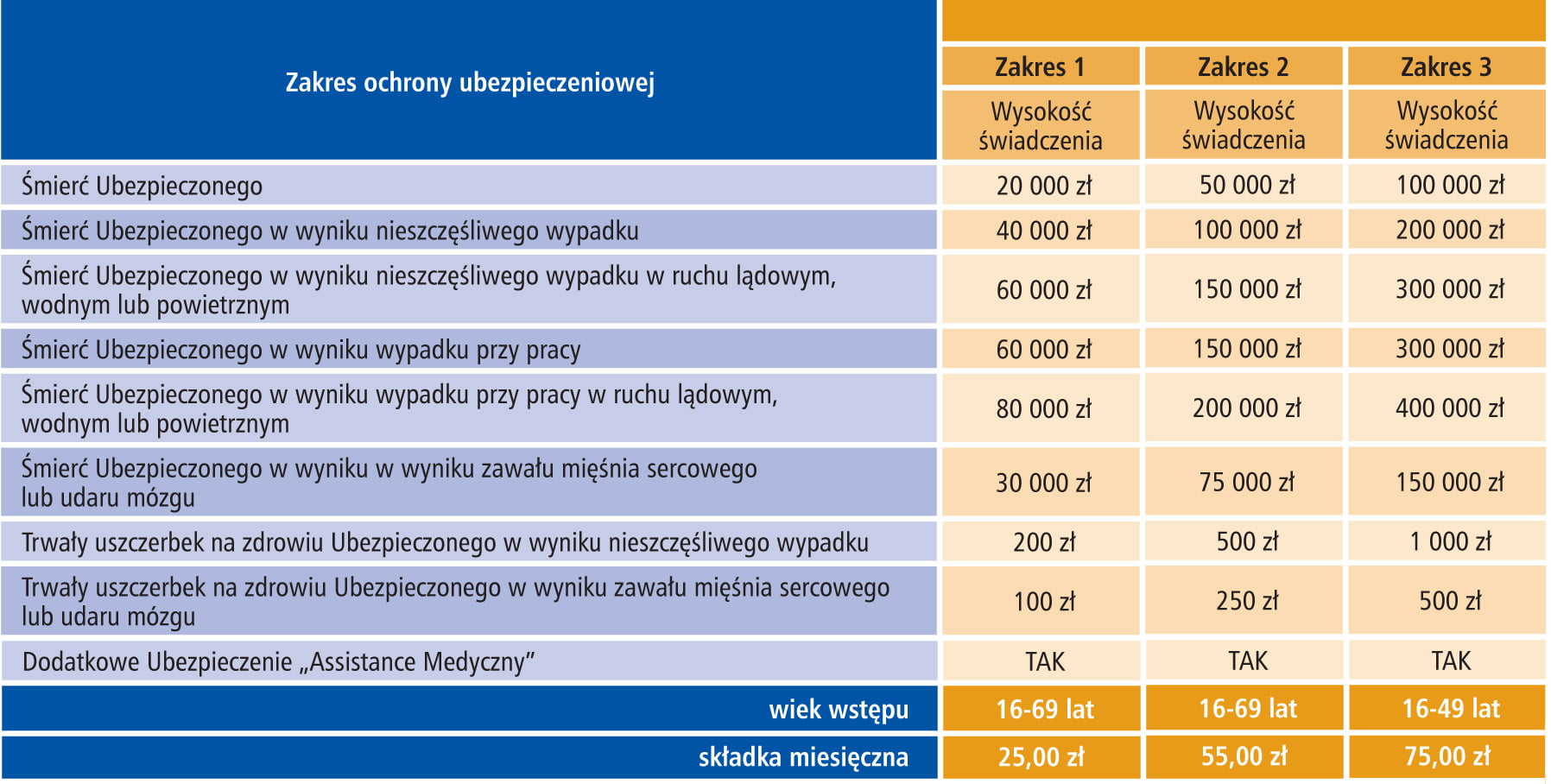

The amount of the payment depends. It varies on the plan selected. It also depends on the length of the hospital stay. Some policies offer additional benefits. These can include coverage for surgery. Or rehabilitation after hospitalization. Review policy details carefully to know exact coverage.

How Educators Can Explain it in Class

This topic can be integrated. It’s relevant in subjects such as economics. It’s also relevant in health and wellness. It can also tie into careers. Start with basic insurance concepts. Introduce the idea of risk management. Discuss why people need insurance.

Use relatable examples. Imagine a teacher needs to stay in the hospital. This insurance can help with costs. This reduces the financial burden. This allows them to focus on recovery. You can relate this to family members. It can affect students too.

Avoid using complicated jargon. Keep your explanation straightforward. "Insurance is like a helping hand". "It protects you when things go wrong". Explain it that simply. Use visual aids such as charts. Or diagrams to illustrate how the policy works. Showing real-life scenarios makes it more engaging.

Engaging Activities

A role-playing activity is great. Students can act as insurance agents. They can also act as policyholders. This allows them to explore different scenarios. They can also learn about the benefits. It reinforces their understanding.

Conduct a debate. The topic can be about the importance of insurance. This encourages critical thinking. It also encourages communication skills. Assign research projects. Have students investigate different insurance plans. They can present their findings to the class. Students can compare different group insurance options.

Invite a guest speaker. An insurance professional can talk about their experiences. They can explain the role of insurance in society. Students can ask questions. This brings real-world context. It makes the topic more relevant.

Common Misconceptions

Many believe insurance is unnecessary. Some think it's only for older people. Emphasize that accidents and illnesses can happen to anyone. Insurance provides financial security. It protects against unexpected expenses.

Another misconception is that all insurance policies are the same. Explain that different policies offer different coverage. Understanding the details is important. Read the fine print. Know what is covered. Know what is not covered.

Some believe it is expensive. Many group policies are affordable. They offer discounted rates. They’re often cheaper. This is because the risk is spread across a large group. Explain the value of peace of mind. This makes the cost worthwhile.

Addressing Concerns

Be open to questions and concerns. Create a safe space for discussion. Acknowledge the complexities of insurance. Explain that understanding it takes time. Encourage students to seek information. Encourage them to ask for help.

Highlight the benefits for families. If a parent is hospitalized, the financial support helps. This ensures stability during a difficult time. This can ease burdens on students. It improves overall wellbeing.

Use reputable resources. The PZU website provides information. Other reliable insurance websites provide details. This helps students research information accurately. It ensures that they are getting correct details.

Benefits for Teachers Specifically

This insurance can be very beneficial. It provides financial protection during a hospital stay. Teachers have stressful jobs. Their health is a priority. This policy offers peace of mind.

It supplements existing health insurance. It fills gaps. This covers expenses. Especially those that traditional health insurance doesn’t cover. This can include deductibles. This also includes co-pays. It also includes non-covered medical expenses.

Teachers can promote this benefit. They can educate other colleagues about it. This helps create a supportive work environment. Encourage enrollment during open enrollment periods. Share information. This is important for fellow employees.

Making It Personal

Share your own experiences. If you know someone who has benefited from the policy. This adds credibility. It shows the real-world impact of insurance. It also builds trust.

Connect with the HR department. They can provide information. They can answer specific questions. This helps teachers understand their options. This makes the enrollment process easier.

Emphasize the long-term benefits. This is a form of financial planning. It protects against unforeseen circumstances. This makes it a valuable investment. It invests in your future.

Final Thoughts

PZU Grupowe Ubezpieczenie Pracownicze Typ P Plus Pobyt W Szpitalu is important. It is an employee benefit. This offers financial security. It promotes well-being. By understanding its features, educators can explain it. They can empower students. They can also protect themselves.

Remember to keep it simple. Use real-life examples. Encourage questions. Address misconceptions. This will help students understand insurance better. It will help them become financially literate. It's also a valuable life lesson.