Hej! Today, we'll explore something in QuickBooks. It's called a "Pending Non Posting Invoice." It might sound complicated, but we'll break it down. Imagine it like ordering pizza online, but not actually paying yet.

What is an Invoice?

First, let's understand invoices. An invoice is a bill. Think of it as a request for payment. You give someone an invoice when they owe you money for goods or services. It's like a receipt, but going the other direction. You receive a receipt when *you* pay someone; you issue an invoice when someone pays *you*.

For example, imagine you are mowing lawns for your neighbors. Once you cut a lawn, you hand them a bill. That's an invoice. It says how much they owe you for your work. It usually includes your name, their name, the date, and the amount due.

Understanding "Posting"

Now, what does "posting" mean in accounting? It’s about recording a transaction. Think of it like writing something down in a ledger. This ensures the transaction gets included in your financial reports. Without posting, the transaction is almost invisible to the accounting system.

Imagine you sold your old video game console on eBay. When you record the sale and deposit the money into your bank account in QuickBooks, that's posting. Your income is now officially tracked in your system. It's included in your profit and loss statement.

"Non-Posting" Transactions

So, what’s a "non-posting" transaction? It's a transaction that doesn’t immediately affect your financial statements. It's like a placeholder. It’s important for planning and tracking. But, it doesn’t change your balances right away.

Think of planning a birthday party. You create a budget and estimate costs for decorations, food, and entertainment. That’s like a non-posting transaction. You haven't actually spent the money yet. You are just preparing and planning your expected expenses.

What is a Pending Non Posting Invoice?

This is the core of our topic. A Pending Non Posting Invoice is an invoice that you create. However, it's *not* immediately reflected in your financial records. Think of it as a draft invoice. You have prepared it, but it hasn't been finalized or sent out, or designated as ready to be sent to the accounting system.

Imagine you’re running a small tutoring business. A student asks you for future tutoring sessions. You create an invoice for those sessions now. But, you won't actually send it until the sessions happen or until the beginning of the month. That preliminary invoice is a Pending Non Posting Invoice.

Reasons for Using Pending Non Posting Invoices

Several reasons exist for using these invoices. The first is for planning. You can see potential income before it arrives. It allows you to get organized. You can track how much you *expect* to earn.

Another reason is for recurring invoices. You might have a client who pays the same amount every month. Instead of creating a new invoice each month, you prepare them in advance. You set them as pending. When the time comes, you simply change them to be posted. It saves time. This helps you to maintain consistency.

Finally, you might use it for estimates. You are preparing a quote to send to a customer. This is close to an invoice, but the customer hasn’t accepted it yet. You can create a non-posting invoice with your estimated charges. Once they accept, you can convert it to a regular, posting invoice.

How it Works in QuickBooks

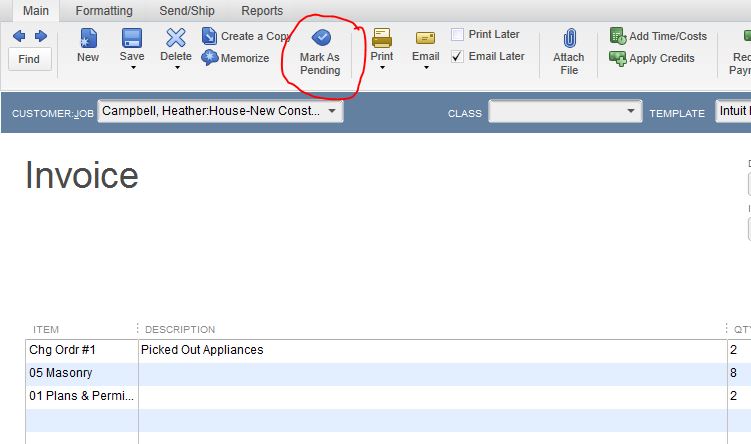

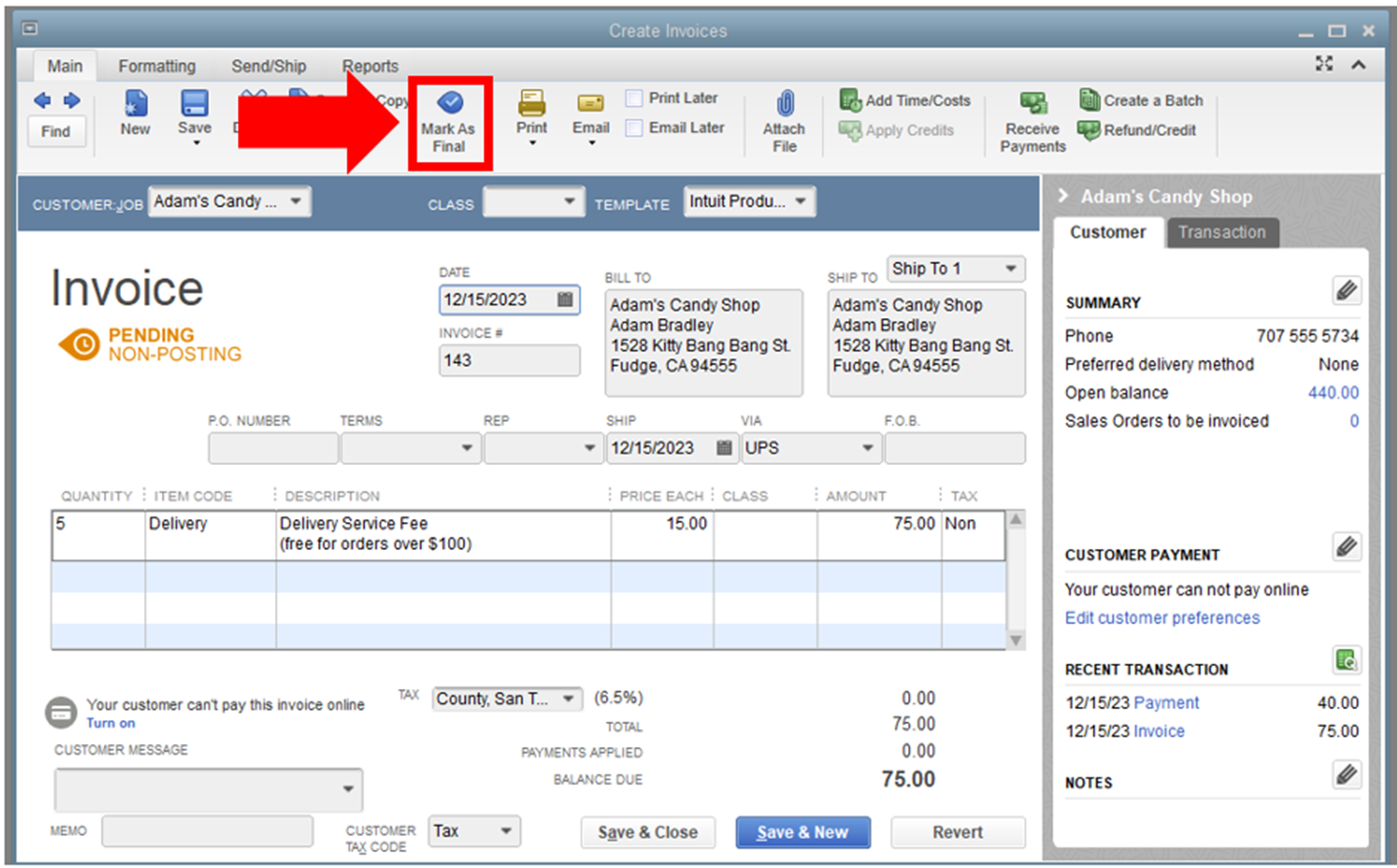

In QuickBooks, you’ll typically create an invoice as usual. However, instead of saving it as a final, completed invoice, you will save it as “pending” or “non-posting”. The exact wording may depend on your version of QuickBooks.

When you’re ready to make it official, you will go back to that invoice. You edit it to remove the "pending" or "non-posting" status. Then, QuickBooks will then post it. This means the income gets recorded. It then shows up in your reports. It is now a normal invoice.

Benefits of Using Pending Non Posting Invoices

Using these invoices offers several benefits. Primarily, it helps with organization. You can manage future income and expenses. It allows you to stay on top of your finances.

It also helps with forecasting. You can see potential revenue. This allows you to plan your spending accordingly. You know your expected income for the next month or quarter.

They are great for automation of repetitive tasks. Setting up invoices in advance that you send out at a later date, reduces the amount of time you need to spend on regular administrative tasks.

Example Time!

Let's say you run a web design business. A client hires you to build a website. You agree on a payment plan. 50% upfront, and 50% upon completion. You create two invoices.

The first invoice, for 50% upfront, is a regular, posting invoice. This is because you expect immediate payment. You send it to the client right away. You expect it to affect your cash flow. You will receive and record the payment.

The second invoice, for the remaining 50%, is created as a Pending Non Posting Invoice. This is because payment is contingent on completion. You don’t want it to skew your current financial reports. You only "activate" it once the website is done.

Key Takeaways

A Pending Non Posting Invoice is a draft invoice. It doesn't immediately affect your financials. It is useful for planning, recurring invoices, and estimates. You save it, and then "post" it later when it is ready.

By understanding this concept, you can better manage your finances. You can organize your invoices more efficiently. You can forecast your income. It allows you to take greater control of your accounting. Remember to always consult the documentation for your specific version of QuickBooks for precise instructions.