Cześć nauczyciele! Let's explore real property tax in the Philippines.

What is Real Property Tax (RPT)?

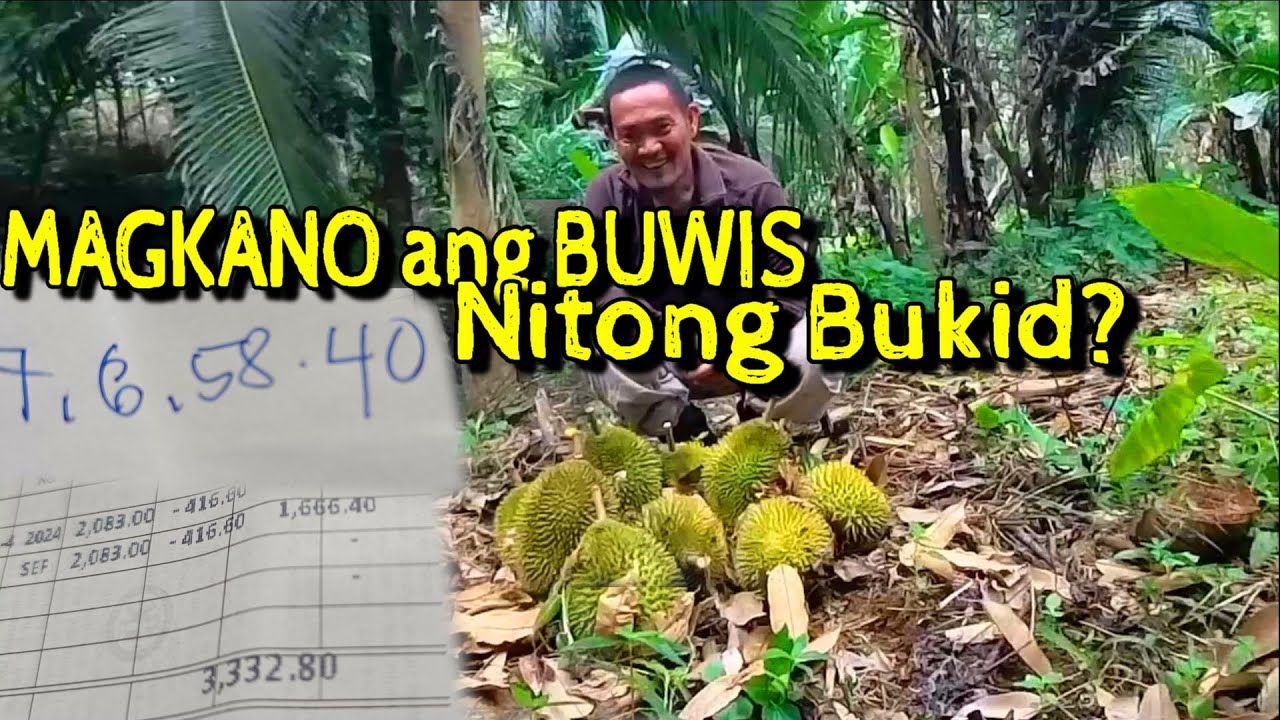

It's a tax on real property. This includes land, buildings, and other structures. The local government collects it.

Who Pays RPT?

Owners of real property pay. This applies to individuals, corporations, and other entities. It's due regardless of whether the property is occupied.

Calculating RPT: Understanding the Basics

Several factors determine the tax amount. Assessed value is a crucial component. The local assessor determines this value.

Fair Market Value is the base. Assessment levels are applied to this. These levels are percentages set by the local government.

The formula is straightforward. Assessed Value = Fair Market Value x Assessment Level. RPT is calculated by multiplying the Assessed Value by the RPT rate.

Where to Find the RPT Rate?

Each local government unit (LGU) sets its own rate. Check with the local treasurer's office. They publish the applicable RPT rates.

RPT rates vary across different municipalities. Consider city versus rural areas. These differences reflect varying needs and revenue generation strategies.

Important Dates and Payment

RPT is usually paid annually. However, installment options exist. The specific deadlines depend on the LGU.

Prompt payment is vital. Late payments incur penalties. Penalties can include interest and surcharges.

Where to Pay RPT?

Pay at the local treasurer's office. Some LGUs offer online payment options. This provides more convenience for taxpayers.

How to Teach RPT Effectively

Simplify the concepts for your students. Use real-life examples. Make it relevant to their lives.

Start with the basics of property ownership. Explain what real property is. Use visuals like pictures of houses and buildings.

Break down the calculation step-by-step. Use sample problems. Allow students to practice calculating RPT.

Role-playing can be engaging. Assign roles like property owner and assessor. This makes learning interactive.

Common Misconceptions

Some believe RPT only applies to residential properties. This is incorrect. It applies to all types of real property.

Another misconception is that renters pay RPT. This is not the case. The responsibility falls on the property owner.

Some think the RPT rate is the same nationwide. This is false. Each LGU sets its own rate.

Addressing Misconceptions in Class

Actively address these misconceptions. Clarify the rules and regulations. Provide accurate information.

Encourage questions and discussions. Create a safe learning environment. Address any confusion students may have.

Making RPT Engaging for Students

Relate RPT to local community development. Explain how RPT funds local projects. Highlight the benefits of paying RPT.

Organize a field trip to the local treasurer's office. This provides a firsthand experience. It allows students to see the process in action.

Invite a guest speaker from the local government. They can share insights about RPT. They can also answer students' questions.

Use online resources and interactive tools. Utilize simulations and games. This enhances engagement and understanding.

Project-Based Learning

Assign projects related to RPT. Students can research RPT rates in different areas. They can analyze how RPT impacts the community.

Students can create presentations or reports. This allows them to demonstrate their understanding. It also develops their research and communication skills.

Tips for Educators

Stay updated on the latest RPT regulations. LGUs may update their policies. Ensure you have accurate information.

Connect with local government officials. Seek their support and resources. This helps you teach RPT effectively.

Tailor your lessons to your students' needs. Consider their age and learning styles. Adapt your teaching methods accordingly.

Emphasize the importance of civic responsibility. Explain how paying taxes contributes to society. Encourage students to be responsible citizens.

Resources for Teachers

The Bureau of Local Government Finance (BLGF) offers resources. Consult their website for information. They provide guidelines and circulars.

Connect with other educators. Share best practices and lesson plans. Collaborate to improve your teaching.

In Conclusion

Understanding real property tax is crucial. It empowers citizens to be responsible taxpayers. Educators play a vital role in imparting this knowledge. By using engaging methods and addressing misconceptions, you can make learning about RPT both informative and impactful for your students. Good luck teaching!